|

M&A Integration Success = Lesser Execution Risk = Financial success When to start M&A Integration ? M&A Integration planning should start very early in the M&A process, preferably at the deal screening stage. M&A Integration or the ease of it should be a big consideration on whether one goes ahead with the deal or not. By the close of the deal, an integration team should be established with clear integration strategies, steps, objectives and timeline. What constitutes M&A Integration ? Before I start, one-size-doesn’t fit all, so please modify accordingly. M&A integration constitutes integration of people, processes and systems(PPS), all of them in a reasonable time without impacting the M&A goals. All three of PPS are intertwined and equally important. People This is probably the most difficult of the integrations. Hence, this needs to start the earliest. Sometimes M&A involves companies from Europe or Asia, the culture and timezones are different. Your best employees are the most vulnerable and will be poached by competitors. So, clear, consistent and transparent communication from executives is the key. Here are some decision points that should be resolved quickly What does the org structure look like ? What is the integrated company culture ? What is the workforce strategy ? Processes “We have always done it this way”. You will hear this a lot. Document and understand the critical processes on both sides in each of the areas (Sales, finance, Engineering, operations etc.) and find a common ground. Rejig the processes to make them more efficient and effective. Systems Systems are the lifeline of the company. Disparate systems will give you misleading and wrong information. So, it is very important to have a single source of truth soon. Key systems should be understood for the combined company. Systems (and the underlying data) should be migrated seamlessly so as not to disrupt the current businesses. What constitutes a successful M&A integration ? A successful M&A integration is one in which the M&A thesis translates into intangible and tangible financial results.

1 Comment

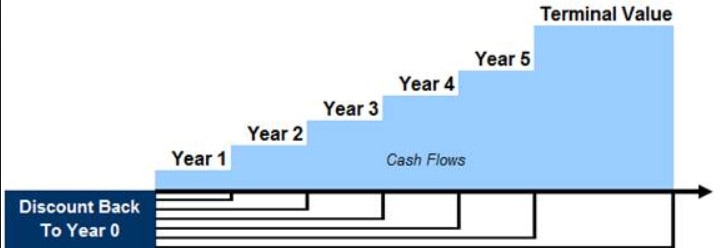

What is a 409(a) valuation ? For a private company, 409(a) valuation decides the value of stock options to be granted to your employees. Usually a DCF or backsolve valuation or a combination is done to get to the option price. I created a model to calculate option pricing using backsolve method. Please feel free to use it to validate your 409(a) valuation. With my compliments, you can follow my slideshow guide to create DCF valuation. Download Option Valuation Sheet Sometime back I trained a few academic folks on DCF valuation. Here is the presentation and an excel file with how to use DCF to calculate company value.

DCF Presentation Download DCF Valuation Sheet |

RSS Feed

RSS Feed