SaaS Business and Metrics

By Rakesh Pullabhatla

10.12.2013

10.12.2013

SaaS is upending the traditional business model and rightfully so. Companies are adopting SaaS software to reduce their internal IT expenses. SaaS companies also in turn use PaaS (AWS) and IaaS(Heroku, Force.com). SaaS business models need significant investment before churning a profit. The simplest example is moving away from onsite Microsoft exchange servers to gmail for so many business.

SaaS puts customer front and center. A good business will effectively acquire, retain and monetize the customer in the most efficient and fastest way. This means effective segregation of the sales org, the “sales and marketing” gets the foot in the door and customer success (Account management) retains and expands the footprint. This is also called “hunter and farmer” model, where the sales is the hunter and Customer success is the farmer.

To note, the sales strategy is also different from traditional sales. Sales needs to be low-touch which means one should consider inside sales and plenty of targeted marketing. Marketing plays a big role in feeding the Marketing Qualified leads to the Sales team. Commissions should be based on MRR or CMRR and not on TCV.

A little about product. The product needs to delight the end customer and preferably should be plug-and-play, think gmail. The product needs to be sticky too so customers might find it difficult to switch to a competitor without disruption. The product also needs to be flexible enough to be easily integrated with any other product without major costs to the customer.

One final note before diving into metrics, SaaS business need to grow like weeds and not like sequoia trees.

How do we define metrics for something this different from traditional businesses? Traditional metrics like Bookings, Billings, ACV and TCV are easily manipulated. Bessemer Venture Partners SaaS “Laws of Cloud Computing” gives great insights and this blog is heavily inspired from that paper.

This is how I think about SaaS metrics, the nomenclature is just for my understanding

Hunter metrics (MRR,CMRR, CAC, CAC Payback period, New Customers)

Farmer metrics (Logo and Revenue Churn and CMRR Renewal)

Other Metrics (ARPA, CLTV, Cash Flow, Gross Profit and Runway)

Let me define some terms

Monthly Recurring Revenue (MRR): MRR is sum of all of your subscription revenue. It might differ from your accounting revenue.

Committed Monthly Recurring Revenue (CMRR): CMRR is next period’s committed MRR as of the end of this period. This will take into account any MRR kickers, committed MRR expansions and churn.

Churn

Logo Churn % is lost customers divided by number of customers at the beginning of period. MRR Churn is same except it is for revenue.

Churn should be less than 5% and aim for MRR churn to be negative i.e. Revenue from same set of customers increases period over period.

ARPA

ARPA is average revenue per acquired customer.

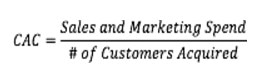

Cost of Acquiring Customers (CAC): Sales and marketing spend divided by number of acquired customers.

SaaS puts customer front and center. A good business will effectively acquire, retain and monetize the customer in the most efficient and fastest way. This means effective segregation of the sales org, the “sales and marketing” gets the foot in the door and customer success (Account management) retains and expands the footprint. This is also called “hunter and farmer” model, where the sales is the hunter and Customer success is the farmer.

To note, the sales strategy is also different from traditional sales. Sales needs to be low-touch which means one should consider inside sales and plenty of targeted marketing. Marketing plays a big role in feeding the Marketing Qualified leads to the Sales team. Commissions should be based on MRR or CMRR and not on TCV.

A little about product. The product needs to delight the end customer and preferably should be plug-and-play, think gmail. The product needs to be sticky too so customers might find it difficult to switch to a competitor without disruption. The product also needs to be flexible enough to be easily integrated with any other product without major costs to the customer.

One final note before diving into metrics, SaaS business need to grow like weeds and not like sequoia trees.

How do we define metrics for something this different from traditional businesses? Traditional metrics like Bookings, Billings, ACV and TCV are easily manipulated. Bessemer Venture Partners SaaS “Laws of Cloud Computing” gives great insights and this blog is heavily inspired from that paper.

This is how I think about SaaS metrics, the nomenclature is just for my understanding

Hunter metrics (MRR,CMRR, CAC, CAC Payback period, New Customers)

Farmer metrics (Logo and Revenue Churn and CMRR Renewal)

Other Metrics (ARPA, CLTV, Cash Flow, Gross Profit and Runway)

Let me define some terms

Monthly Recurring Revenue (MRR): MRR is sum of all of your subscription revenue. It might differ from your accounting revenue.

Committed Monthly Recurring Revenue (CMRR): CMRR is next period’s committed MRR as of the end of this period. This will take into account any MRR kickers, committed MRR expansions and churn.

Churn

Logo Churn % is lost customers divided by number of customers at the beginning of period. MRR Churn is same except it is for revenue.

Churn should be less than 5% and aim for MRR churn to be negative i.e. Revenue from same set of customers increases period over period.

ARPA

ARPA is average revenue per acquired customer.

Cost of Acquiring Customers (CAC): Sales and marketing spend divided by number of acquired customers.

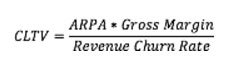

Customer LifeTime Value (CLTV): In short, this is the value of profits generated by a given customer over the lifetime discounted at the company’s discount rate.

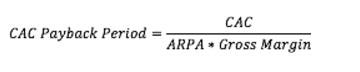

CAC Payback period : It’s the time to recover the cost of acquiring a customer.

Difference between CAC Payback period and CLTV is the former is risk metric whereas the latter is return metric. You need to maximize your returns for the risk level assumed.

Cash flow

Cash is always the king. A SaaS company needs to keep a close eye on the cash inflows from customers and ensure that AR is collected on time.

For accurate results on all the metrics, it's best to do a cohort analysis.

See the SaaS metrics in Google Sheets here from Christoper that you can use to track all these metrics.

Great So what ?

Mind the funnel: Understand every aspect of the funnel, right from getting leads into the funnel to becoming a customer. Make science out of it and track every aspect of it. For eg. which channels are good leads coming from and what is the ROI of each channel? Once inside the funnel track every conversion ratio for each channel. At the minimum once in the channel how many leads become MQL, SAL, opportunity and ultimately into customers.

So What ? If you know and mastered your funnel math, you know exactly how much you need to spend in marketing dollars and sales reps to get the needed revenue. You can now scale it as much as you want.

Farming the customer : Don’t stop tracking the customer. SaaS business work wonderfully in the “land and expand” mode. If closing the sale means selling just 1 license, do it and then let the product and customer success do its magic.

So What ? If your customers can be evangelists you have created another marketing channel. Track customers with MMR Renewal, MMR Expansion, Revenue and Logo Churn. Customer Success commision should be dependent on MRR Expansion and Revenue churn. You will also improve the unit economics by minding your current customer base. Recall CLTV

Cash flow

Cash is always the king. A SaaS company needs to keep a close eye on the cash inflows from customers and ensure that AR is collected on time.

For accurate results on all the metrics, it's best to do a cohort analysis.

See the SaaS metrics in Google Sheets here from Christoper that you can use to track all these metrics.

Great So what ?

Mind the funnel: Understand every aspect of the funnel, right from getting leads into the funnel to becoming a customer. Make science out of it and track every aspect of it. For eg. which channels are good leads coming from and what is the ROI of each channel? Once inside the funnel track every conversion ratio for each channel. At the minimum once in the channel how many leads become MQL, SAL, opportunity and ultimately into customers.

So What ? If you know and mastered your funnel math, you know exactly how much you need to spend in marketing dollars and sales reps to get the needed revenue. You can now scale it as much as you want.

Farming the customer : Don’t stop tracking the customer. SaaS business work wonderfully in the “land and expand” mode. If closing the sale means selling just 1 license, do it and then let the product and customer success do its magic.

So What ? If your customers can be evangelists you have created another marketing channel. Track customers with MMR Renewal, MMR Expansion, Revenue and Logo Churn. Customer Success commision should be dependent on MRR Expansion and Revenue churn. You will also improve the unit economics by minding your current customer base. Recall CLTV

Increasing the Customer Lifetime can be done by increasing ARPA or reducing Churn Rate, assuming a constant Gross Margin (more on Gross Margin later). Aim for CAC/CLTV to be less than 3.

Keep a constant tab on your Net Promoter score. More details here.

Stepping on the GAS CAC payback period gives you the best ratio on when to start investing aggressively.

Keep a constant tab on your Net Promoter score. More details here.

Stepping on the GAS CAC payback period gives you the best ratio on when to start investing aggressively.

In economics terms, this tells you how many months it takes to recover your Sales and Marketing investment. Of course, you would want it as low as possible. As a rule of thumb if CAC payback period is less than 12 months then step on the gas to corner the market.

Gross Margin: Initially, all SaaS businesses have gross margin in 60% range. However, as the business matures and economies of scale start taking shape, gross margin should be 80%+.

All these metrics tell a story and describe the health of the business.

Gross Margin: Initially, all SaaS businesses have gross margin in 60% range. However, as the business matures and economies of scale start taking shape, gross margin should be 80%+.

All these metrics tell a story and describe the health of the business.